Flexygate Income REIT

Founded in 2012, FlexyGate was recently named the #1 real estate crowdfunding platform by Motley Fool1. Our mission? To help investors build wealth through commercial real estate.

For 63 months consecutively, our Income REIT has been doing exactly that by paying investors an annualized cash distribution of between 6-8% (net of fees).2

$34MM

TOTAL ASSET VALUE

$22.3MM

DISTRIBUTED TO INVESTORS

14.8%

LTM RETURNS AS AT 3/31/2022

68 MONTHS

CONSECUTIVE DISTRIBUTION PERIODS

Start Your Investment Now

Over $21.7 MM distributed to investors to date

- Paid investors an annualized cash distribution of between 6-8% (net of fees) for 67 months

- Distributed a total of $21.7 MM to investors to date.

- Delivered a 14.8% total return for the last twelve months.2

- $345,000,000 in assets purchased by approximately 6,925 unique investors.3

what would happen if you invested $10k?

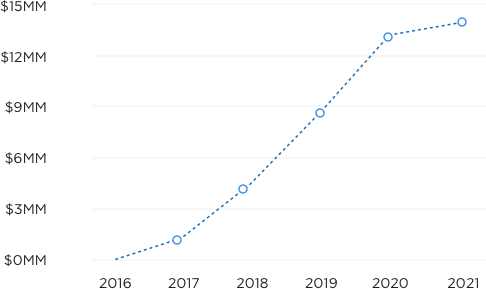

If you invested $10,000 in the FlexyGate Income REIT at inception and reinvested all of your monthly distributions, your investment would now be worth $15,440:

Based on a $10,000 initial investment in 20165

Cumulative Distributions

Consecutive Distribution Periods

63 months

Portfolio breakdown

Multi-Family

Properties that have five or more residential units in a single building and may be further classified as garden style, low-rise, or high-rise

Office

Mid-rise or high-rise, downtown or suburban.

Retail

Grocery-anchored centers, shopping centers, power centers and strip malls.

Joint Venture Equity

Investors in Joint Venture Equity own an interest in an entity (usually an LLC) that invests in the equity portion of a property. After all debt is paid, and any Preferred Equity distributions are made, the Joint Venture Equity investor receives a pro rata portion of a preferred return, cash flow, and any profits upon sale. Joint Venture Equity is the riskiest investment as it has the lowest priority of distributions, although it has the greatest upside potential.

Mezzanine Debt

Second in line for repayment are investors in Mezzanine Debt and B Notes. Mezzanine Debt is structured as a loan secured by a pledge of interest in the entity owning the property. In the event of loan default, investors may have the right to foreclose on the interests of the entity and step into ownership of the property, subject to any senior debt. B Notes are secondary tranches of senior loans with an A/B structure, and are secured by the property itself. In the event of loan default, the investors in a B Note may participate in the right to foreclose on the property and receive sale proceeds to repay principal, unpaid interest and any fees, subject to the A Note investor.

Preferred Equity

Investors in Preferred Equity investments own an interest in the property and have a priority over the other equity investors to receive distributions of cash flow and capital invested. In the event of loan default, Preferred Equity investors may have the right to take over control and management of the property.

Disclaimers and Risk Factors

Investing in the Company’s common shares is speculative and involves substantial risks. The Company cannot assure you that it will attain its objectives or that the value of its assets will not decrease. Therefore, you should purchase these securities only if you can afford a complete loss of your investment.

You should carefully review the “Risk Factors” section of this offering circular, beginning on page 26, which contains a detailed discussion of the material risks that you should consider before you invest in our common shares. These risks include the following:

- The FlexyGate Income REIT has limited operating history.

- Because no public trading market for shares of our common stock currently exists, it will be difficult for an investor to sell their shares and, if an investor is able to sell their shares, they will likely sell them at a substantial discount to the public offering price.

- We may be unable to pay or maintain cash distributions or increase distributions over time.

- The REIT’s ability to implement its investment strategy is dependent, in part, upon its ability to successfully conduct this offering through the FlexyGate Platform, which makes an investment in it more speculative.

- Future disruptions in the financial markets or deteriorating economic conditions could adversely impact the commercial real estate market as well as the market for debt-related investments generally, which could hinder our ability to implement our business strategy and generate returns to you.

- This is a blind pool offering, and the REIT is not committed to acquiring any particular investments with the net proceeds of this offering.

- There are conflicts of interest between the REIT, its Manager and its affiliates.

- Our investments may be concentrated and will be subject to risk of default.

- We are dependent on our Manager and Flexy Gate, Co.’s key personnel for our success.

- Failure to qualify as a REIT would cause the Company to be taxed as a regular corporation, which would substantially reduce funds available for distributions to our shareholders.

- The REIT may allocate the net proceeds from this offering to investments with which you may not agree.

Note: The foregoing statements may contain forward-looking statements and are based on our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements.

1. Source: https://www.millionacres.com/real-estate-investing/crowdfunding/top-real-estate-crowdfunding-sites/

2. As with all investments, past performance does not guarantee future results and there is no guarantee that the REIT will make distributions.

3. September 30, 2021 compared to September 30, 2020.

4. Aggregate value of all underlying properties in FlexyGate Income REIT, LLC is based on the most recent internal valuations as of June 30, 2021 pursuant to our valuation policies, provided, however, the property value of investments made since that date is based on the most recent purchase price . The aggregate value of the properties underlying loans made by FlexyGate Income REIT, LLC is based on independent appraisals dated within six months of the original acquisition dates by FG Adviser, FlexyGate as applicable. As with any methodology used to estimate value, the methodology employed by our affiliates’ internal accountants or asset managers is based upon a number of estimates and assumptions about future events that may not be accurate or complete. For more information, see the “Description of Our Common Stock – Valuation Policies” section of our offering circular.

5. These hypothetical case studies are provided for illustrative purposes only and do not represent an actual investor or an actual investor’s experience, but rather are meant to provide an example of the REIT’s process and methodology. An individual’s experience may vary based on his or her individual circumstances. There can be no assurance that the REIT will be able to achieve similar results in comparable situations. Hypothetical returns are net of advisory fees and transaction costs; all dividends are assumed to be reinvested annually. Actual returns may differ materially from hypothetical returns. Hypothetical returns are from FlexyGate Income REIT inception date thru July 21, 2021.There is no substitute for actual returns. Past hypothetical performance is not a guarantee of future returns.