ACCESS THE FULL POTENTIAL OF COMMERCIAL REAL ESTATE

INVESTING IN REAL ESTATE INVESTMENT TRUSTS (REITS)

UNDERSTANDING THE BASICS OF A REIT

A Real Estate Investment Trust, or “REIT”, is a single investment into a diversified basket of real estate properties

REITs are legally required to distribute 90% of all taxable income to investors on a yearly basis

REITs are often diversified by property type, geography, or multiple categories to achieve strategic objectives

REITs have historically been positively correlated with inflation, which may make them a possible hedge for inflation

INVESTMENT OBJECTIVES

REITS are typically known for their objective of regular distributions, as well as moderate long-term capital appreciation, though they may offer other potential benefits.

______________________________________________

Income

______________________________________________

______________________________________________

Inflation hedge

______________________________________________

Portfolio diversification

______________________________________________

Simplified tax reporting

______________________________________________

Capital preservation

______________________________________________

Professional management

______________________________________________

COMPARING AVAILABLE REITS

In the broader investment market, investors have access to three types of REITs

• Public non-traded REITs

• Public traded REITs

• Private REITS (Non-traded)

ANNUALIZED RETURNS (%) AS OF 12/31/20

A PERFORMANCE HISTORY WORTH CONSIDERING

Over the long term, REITS have compared favorably to traditional investment indexes, such as the S&P 500.

MEET THE REITS

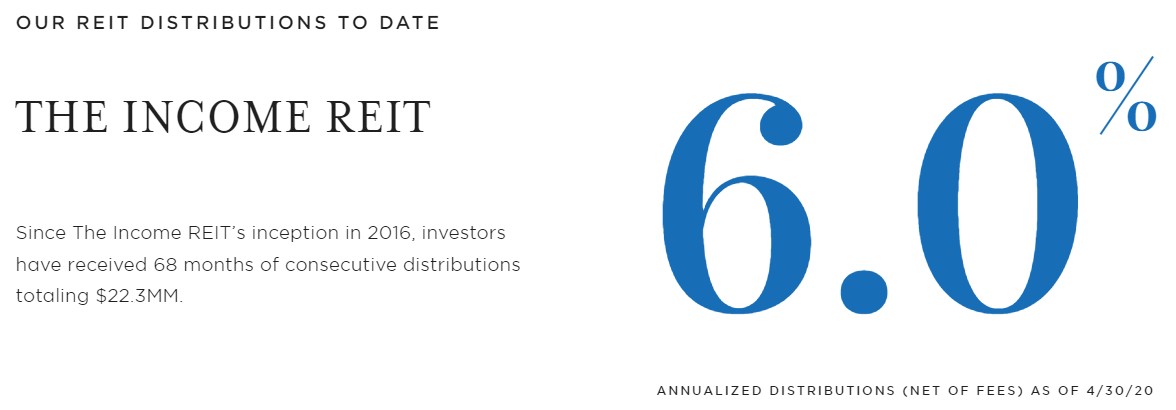

The focus of The Income REIT is to provide monthly income to investors through contractually obligated interest payments.

The focus of The Apartment Growth REIT is on long-term capital appreciation, in addition to providing quarterly income.

IRA INVESTING

On the FlexyGate platform, you have the option to invest into one of the REITs using a Self-Directed Individual Retirement Account (SD-IRA) either by rolling over funds from an existing IRA or opening a new IRA, directly with us.

LONG-TERM STRATEGIES

For investors looking to grow their retirement savings with a buy-and-hold investment strategy, The Apartment Growth REIT offers multifamily properties with value-add opportunities and appropriate risk-adjusted returns as well as the potential for value appreciation.